Why RMB Internationalization Will Continue in New Global Era

The world is changing. Geopolitical shifts, particularly Donald Trump's second term as US president, seem certain to reshape the global economy, trade dynamics, and the investment landscape. Talk of tariffs and protectionism has raised questions about the internationalization of the Chinese currency, despite its growing presence in the global marketplace over the past decade. Despite this backdrop, however, we believe there is great potential for the RMB to play a more significant role in global markets in this new era.

In this article, we will explore a number of structural factors that are boosting use of the RMB in global trade and making it an increasingly good fit for investors looking for non-US dollar assets. These factors include easier market access, greater liquidity and lower foreign-exchange volatility. We are also relatively optimistic about Chinese exports as the economy broadens and more Chinese companies expand into new export markets – many of them in the faster-growing and unaligned economies of the Global South. China's continued leadership in many areas of advanced technology and in the production of innovative digital, electronic, autonomous goods also supports its export competitiveness.

We also note that the RMB has been rapidly gaining ground in international trade and finance in recent years, driven by the government's efforts to internationalise the currency. In 2024 alone, some of the notable landmarks included the RMB surpassing the Japanese yen to become the fourth most-used currency for global payments, record issuance of panda bonds, and the value of RMB assets held by overseas entities approaching RMB10 trillion. The RMB overtook the US dollar as the most-used currency in Chinese cross-border receipts and payments in 2023.

This article takes a deeper look at the main drivers of RMB usage in a global context, by outlining the milestones and providing analysis that support our view that the outlook for the currency's internationalization is positive. While the Chinese currency may face short-term headwinds, we believe the prospects for international usage are underpinned by long-term structural changes in both the domestic and global economies.

The Building Blocks of Internationalization

Rising use of the RMB has gone hand in hand with the growing diversity of market participants, including corporates, banks, asset managers and hedge funds. This in turn has enhanced the currency's liquidity and tradability, as well as the resilience of the market.

Another positive factor has been that during a period of dollar strength, the RMB, also known as the Chinese yuan (CNY), has exhibited lower volatility compared to other currencies with high volumes in the global interbank payments system. Even during times of stress – such as the 2018-2019 trade war under Trump's first term, the 2020 COVID-19 outbreak, and early in the 2022 Russia-Ukraine conflicts – the rise in realized volatility in the USDCNY has been much milder than that in other major currency pairs.

Fuelled by the rising competitiveness of its exports, as mentioned earlier, China has continued to lead the boom in global e-commerce. The trade war of Trump 1.0 also drove the acceleration of Chinese companies going global, together with so-called friendshoring – sourcing from, supplying to, and manufacturing in friendly countries. Both of these trends have further facilitated more use of the RMB in international trade and investment.

Despite these visible increases, the international use of the RMB today does not match China's overall economic heft, given the size of the country's economy. On a purchasing power parity basis, China accounted for 19% of world GDP in 2024. By contrast, the RMB's share of global payments and foreign-exchange reserves remains below 5%.

Still, while there remains ample room for greater RMB adoption, it is important to recognize the scale and scope of the achievements over the past decade.

In 2015, we saw the launch of the Cross-border Interbank Payment System (CIPS) as an alternative to SWIFT – the Belgian-based Society for Worldwide Interbank Financial Telecommunication. A year later, the RMB was first included in the International Monetary Fund's currency basket of Special Drawing Rights (SDRs). Then came the launch of RMB-denominated oil futures contracts on the Shanghai International Energy Exchange in 2018. The currency's weight in the SDR basket was increased in 2022. The following year saw the addition of Swap Connect to the series of trading links between mainland markets and China's Hong Kong, designed at enhancing cross-border access and liquidity (including Bond Connect in 2017 and Stock Connect in 2014).

Such achievements could not have happened without China's commitment and determination to open up its capital markets and to push forward RMB internationalization. There are clear strategic goals of enhancing China's Hong Kong's role as an offshore RMB financial centre, strengthening ties with countries under the Belt and Road Initiative and elevating the instrumental role played by RMB-clearing banks and bilateral currency swap programmes.

Taking a closer look at how the RMB has been used, ranging from its share in international reserves and the global payments system, to foreign-exchange transactions, offshore RMB clearing and trading, and RMB financing, we can see progress on a variety of metrics. We summarize each of these areas in turn, before exploring the potential for further advances in more detail.

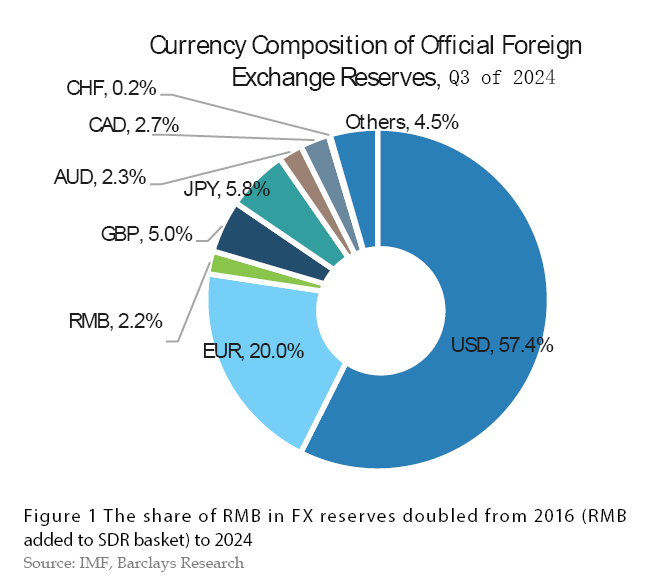

International reserves: According to a report from the People's Bank of China (PBOC), more than 80 foreign central banks have added the RMB into their foreign-currency reserves. Meanwhile, the IMF's data on Currency Composition of Official Foreign Exchange Reserves (COFER) show that the RMB's share of the global total doubled to 2.2% in the third quarter of last year from 1.1% at the end of 2016, when the currency was included in the IMF SDR basket (Figure 1).

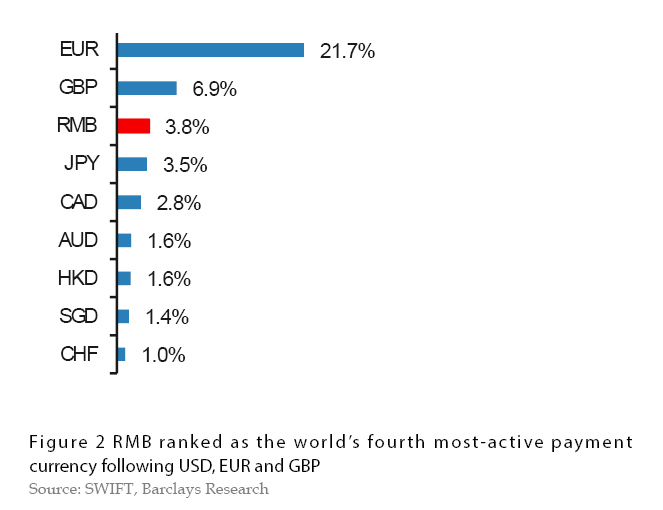

International payments: The use of the RMB in international payments has also increased notably. In 2011, the RMB was ranked the 17th global payments currency, accounting for 0.3% of payments, according to SWIFT. That share has been increasing, and in December 2024, usage reached 3.8% of global payments (Figure 2). Only the USD, EUR, and GBP ranked higher.

Foreign-exchange transactions: The RMB ranked as the fifth most active currency for foreign-exchange spot transactions by value at the end of 2024, after the USD, EUR, GBP and JPY, SWIFT data show. The top four economies conducting foreign-exchange spot transactions in RMB were the UK (43%), US (15.7%), France (10%) and China's Hong Kong (8.9%), which together accounted for nearly 80% of all RMB spot transactions.

Offshore RMB clearing: China has further enhanced its offshore RMB clearing capabilities. By signing RMB clearing arrangements with three more countries (Brazil, Cambodia and Serbia) since 2023, it has now established a network of 33 designated offshore RMB clearing banks in 31 countries and regions. These banks processed RMB636.5 trillion in 2023, up 26.3% from the previous year. That points to a growing use of the currency in cross-border transactions to facilitate trade and investment.

Trading volumes in offshore RMB markets: The offshore RMB trading volume has also been steadily increasing. As of the end of 2023, RMB deposit balances in major offshore markets reached RMB1.54 trillion, returning to their historical high.

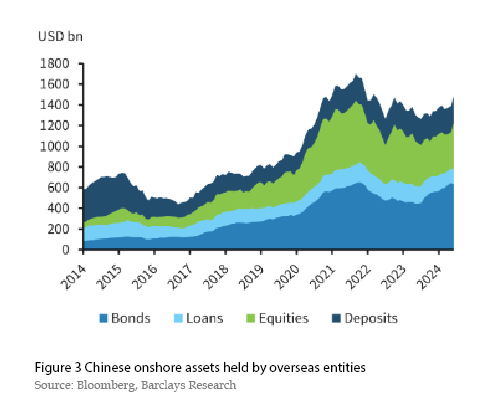

Onshore financial assets held by overseas entities: According to data from the PBOC, the value of domestic RMB financial assets held by overseas entities totalled RMB9.8 trillion as of December 2024, which includes equities, bonds, loans and deposits. This represents a significant increase from RMB2.9 trillion at the end of 2013.

Structural Flows Support Further Progress

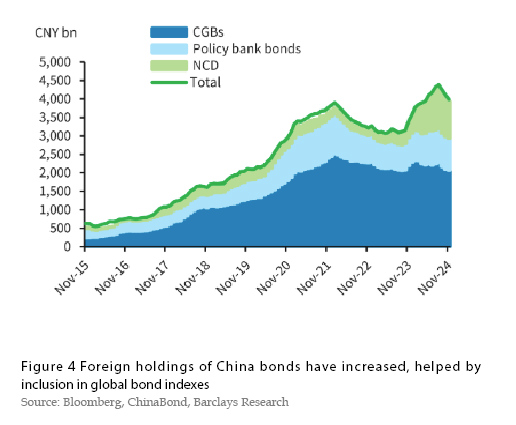

The increase in foreign holdings of RMB assets has come as China has further liberalized its financial markets as part of efforts to promote internationalization of the currency. Cumulative foreign investment inflows into local bonds and equities both rose sharply in the three years from 2019, when Chinese government bonds (CGBs) were first included in leading global indices.Specifically, foreign institutional and retail investors held RMB4.2 trillion of bonds, RMB2.9 trillion of equities, RMB1.7 trillion of deposits, and RMB0.9 trillion of loans as of September 30, 2024. While these amounts appear large in themselves, their holdings of onshore equities account for only 3.8% of China's total equity market capitalisation (A shares and B shares). These holdings also appear modest compared with foreign participation in other major equity markets: foreign investors account for around a fifth of the market in the US and Japan, and more than half in the UK. Similarly, foreign participation in China's onshore bond market remains small, at around 3.5%. Mandates for China investment, diversification of foreign-exchange reserves, sovereign wealth fund (SWF) and index-related flows are likely to continue in the medium term. Foreign holdings remain concentrated in CGBs (RMB2 trillion as at the end of 2024), accounting for around 52% of total foreign investment in China's bond markets, with holdings of policy bank bonds the next largest segment at RMB842 billion, or 21% of the total.

While the geopolitical challenges are apparent, the relatively low foreign-exchange volatility and low correlation with other fixed-income products globally are notable and offer risk diversification for international investors. In short, with a supportive PBOC pushing for capital account liberalization and a stable RMB, foreign participation in China's bond markets is likely to continue in the long term, driven by reserve diversification, SWF flows and increasing China mandates among institutional investors.Similarly, we are optimistic about the role of the RMB as an international reserve currency. Although having doubled its market share to now rank as the world's fifth-largest component of worldwide foreign-exchange reserves held by countries, this still appears low against the proxy weight for China's share of world GDP or its trade openness – China's total imports and exports account for around 5.6% of global GDP.

If the pace of increase in the R