China – Thailand Cooperation on Enhancing Cross-Border Trade with Local Currency

By Financial Market Department, Bank of Thailand

Since 2020, the Bank of Thailand (BOT) has initiated a new foreign exchange (FX) ecosystem to promote efficiency in Thai FX market. Under this initiative, the BOT has relaxed foreign exchange regulations to allow businesses to better manage foreign exchange exposures, and to support market competition among financial service providers with the aim of lowering transaction costs, expanding variety of financial products and increasing accessibility to foreign exchange hedging tools by businesses.

Local currency plays a crucial role in this new FX ecosystem in response to the increasing volume of cross-border trades between Thailand and regional markets. In 2024, Asian emerging market economies have experienced substantial growth accompanied by expansion in trade within the region, with merchandise goods trade exports increasing by 3.4% and imports by 3.6%. For trades in services, exports grew by 8.6% and imports grew by 6.2%, both outperforming global average.1

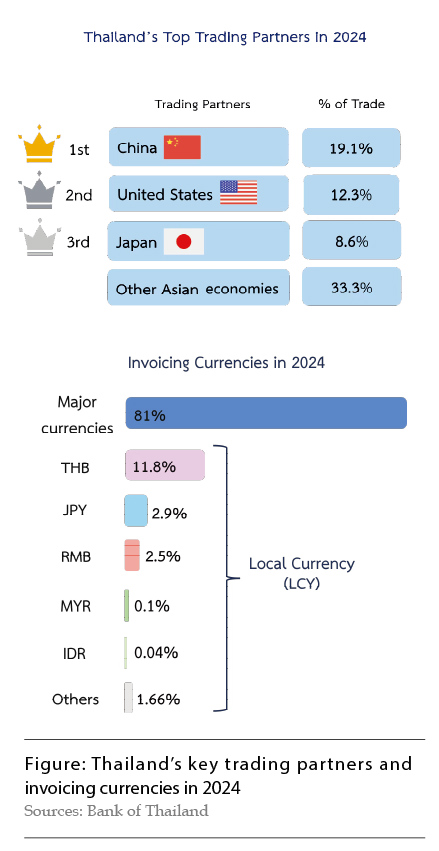

As for Thailand in 2024, nearly 61% of total trade was with Asian economies. Thailand's key trading partners include China, Japan, and ASEAN members such as Indonesia and Malaysia. However, it is noteworthy that only 17.4% of transactions were settled in local currencies2.

Given the highly correlated relationship among regional economies, regional currencies often exhibit high correlation with each other, which leads to relatively lower volatility within the region. As a result, businesses can manage exchange rate risk by using local currency for their settlements. This is especially useful for small and medium-sized enterprises (SMEs) who may have limited credit lines with banks and thus limited access to tools like FX forwards and options. Moreover, businesses paying or receiving domestic currencies may experience lower operational costs since they do not have to pay for fees associated with FX transfers, conversions, and hedging. With the use of local currencies, together with other policies in the new FX ecosystem, businesses would be able to transact in foreign currencies much more flexibly with various alternatives for managing FX risks.

The Bank of Thailand's Policies for Encouraging the Use of Local Currency

The BOT has embarked on a long journey of over a decade to encourage the use of local currency as an alternative for managing currency risk and reducing operational costs for businesses. Our efforts are focused on addressing business pain points, particularly those caused by foreign exchange regulations, as well as promoting awareness and understanding of the availability and benefits of local currency and its usage.

The BOT has long been in discussion with domestic businesses and commercial banks to gather feedback on the use of local currencies in cross-border trade transactions. Notably, businesses engaged in international trade have shared that using the local currency to settle transactions has effectively reduced the volatility of their revenues and expenses, as well as facilitating easier price negotiations. With increased accessibility and liquidity, local currencies, including Renminbi (RMB), have emerged as a convenient and efficient option for mitigating exchange rate risks, boosting revenue, reducing costs, and allowing businesses to allocate more time to their core business operations.

Despite an increase in the use of local currency, the BOT, businesses, and commercial banks agree that the regulations for exchanging local currency in the region, as well as the transaction processes, remain somewhat complex. This complexity has resulted in the use of local currency for cross-border trades not being as widespread as it could be.

Therefore, the BOT has collaborated with various central banks in the region, including Malaysia, Indonesia and China, as well as relevant government agencies, to address these issues through in-depth discussions, information sharing, and implementation of joint projects to support the efficient FX ecosystem. These efforts are aimed at reducing limitations and increasing convenience in using local currencies for cross-border trades for both financial institutions and businesses. The cooperations have taken various forms, depending on pain points of local currency usage faced by different business sectors in different countries and regions.

For example, the BOT jointly established the Local Currency Settlement Framework (LCSF) with the Bank Negara Malaysia (BNM) in 2016 and with the Bank Indonesia (BI) in 2018. Under this framework, selected commercial banks, known as Appointed Cross Currency Dealers (ACCDs), are granted greater flexibility in liquidity management under the scheme. Thai businesses can now maintain Foreign Currency Deposit (FCD) accounts denominated in MYR or IDR with commercial banks located in Thailand. Importers and exporters can deposit their earnings in MYR and IDR into these FCD accounts and either convert them into THB or use them to settle future payments in the respective currencies, thereby reducing the need for multiple foreign exchange transactions and improving liquidity management for both banks and businesses.

China and Thailand's Initiatives and Collaborations to Promote the Use of Local Currency

Over the years, Thailand and China have had a longstanding relationship and collaborations in various areas, including trade and investments. In terms of trade, China has remained Thailand's largest trading partner for 11 consecutive years. Despite the global trade disruptions caused by Covid-19, the trade volume between Thailand and China has continued to grow, accounting for 19% of Thailand's total trade in 2024.

This can be attributed, in part, to the enhanced financial and logistical connectivity. For example, the export of Thai fruits to China has benefited from integrated regional logistics, including improved temperature-controlled supply chain. This helps avoid delays at ports and ensure freshness and quality of products for consumers. This positive development is reflected in a 27% increase in fruit exports from Thailand to China from 2022-2023.

As per trade data3, local currency usage in THB and RMB for cross-border trade with China increased to 18.4% in 2024, comprising 6.5% in THB and 11.9% in RMB. Notably, the usage