The Growing Economic Ties between China and ASEAN

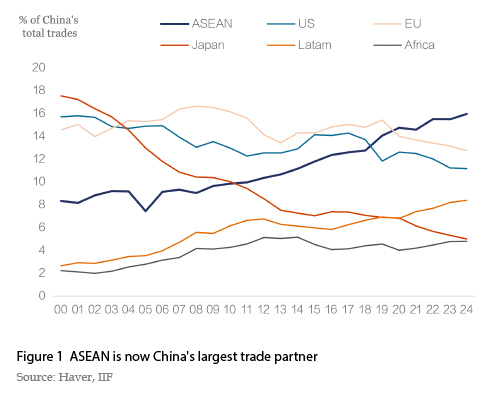

The past decade witnessed a surge in trade and foreign direct investment (FDI) between China and the Association of Southeast Asian Nations (ASEAN), driven by supply-chain reconfiguration, enhanced transportation infrastructure and the implementation of the Regional Comprehensive Economic Partnership (RCEP) in 2022. ASEAN surpassed the US in 2019 and the EU in 2020 as China's (data source: General Administration of Customs of China, hereinafter referred to as China) largest trading partner (Figure 1). Despite concerns about the growing trade deficit with China, we believe that ASEAN countries benefit from expanding trade and FDI. To enhance the economic benefits for ASEAN, China should promote imports from the region and make its FDI in the region more effective at creating jobs and value-added.

ASEAN's trade balance with China has shifted from small surpluses to deficits since 2012 (Figure 2). By 2024, this deficit had expanded to US$190 billion (5.7% of ASEAN GDP), while ASEAN's trade surplus with the rest of the world increased to US$239 billion (7.1% of GDP). The combination of a widening trade deficit with China and a surplus with the rest of the world suggests that many imports from China are utilized for downstream processing and assembly.

The experiences of ASEAN countries exhibit notable diversity. Vietnam stands out in processing trades, with its 2024 trade surplus with the rest of the world being 1.4 times its trade deficit with China. Singapore exhibits a similar trade imbalance but for different reasons. Singapore's imports from China are primarily used in infrastructure (e.g., construction machinery) and consumption (e.g., vehicles and electronics). Thailand's surplus with the rest of the world is smaller than its deficit with China, which suggests that a large portion of its imports from China are used for domestic consumption rather than processing trades or re-exports. Indonesia's trade with China is roughly balanced due to China's demand for Indonesian commodities. Malaysia, on the other hand, runs a trade surplus with China, driven by energy and semiconductor products.

Vietnam's imports from China have increased the most, growing almost 8 times over the past 15 years. Machinery and equipment have dominated Vietnam's imports from China over the past decade, surging nearly 14-fold in the past 15 years and now accounting for 47% of total imports from China (Figure 3). Textiles, metals, and other industrial materials make up another 38% of imports. Vietnam's imports of consumer goods, including cars, remain limited. Vietnam is rapidly industrializing and becoming a crucial link in the global supply chain.

<