Resolving China's Financial Risks

What is the most important topic in the financial sector? In my view the top priority is how to maintain financial stability,specifically how to deleverage and defuse financial risk. In short,the aim is to prevent the arrival of a "gray rhino"- or an obvious danger that we ignore.

People are more familiar with so-called ¡°black swan¡± events,the unexpected developments that could trigger a crisis. Unlike the black swan,the "gray rhino" refers to a high probability of risk. There is a warning sign before disaster strikes,but it is often overlooked or neglected. Michele Wucker,an American economic and crisis policy researcher,first proposed the concept in her book,The Gray Rhino,published in 2016. The financial risks discussed in this article are,to a large extent,those gray rhino issues - seemingly far away but actually looming.

Defusing financial risk is an issue that is important to China and the world. China's current debt burden,which requires deleveraging through monetary policy,regulatory coordination and structural reform,has created a consensus on how to reduce financial risk. However,leverage is high not only in China,but also elsewhere around the globe.

According to the Institute of International Finance (IIF),in the third quarter of 2017 total global debt was US$233 trillion,which was up US$88 trillion compared with a decade ago,accounting for 318% of global GDP. Excessive debt was seen as one of the triggers of the 2008 financial crisis. And now global debt is higher than it was then. Is the problem worse? Debt is high and so far this has not caused a new crisis. Is it because the ability to manage risk has increased,or is global debt allocation more reasonable than before? Or is it just our good fortune that one has not yet arrived? At the moment,global asset prices are not low. The world economy is improving but could still falter. Pressure for monetary policy normalization is gradually increasing,economic performances are uneven and economic and financial policies remain divergent. Meanwhile,political risks remain. These factors underscore the difficulties in dealing with significant financial problems such as elevated levels of debt.

On October 5,2017,Christine Lagarde,managing director of the International Monetary Fund (IMF),spoke at Harvard University. The theme of her speech,¡°Mend the roof when the sun shines," was that the global economy has made a gentle recovery,the banking sector has stabilized,and financial conditions have improved. So it’s time to take appropriate policy measures to make structural reform and reduce excessive debt. In response to my question,"Will high global debt levels trigger another financial crisis," Lagarde replied that this problem is not a cause for alarm,but certainly of concern. The IMF's Global Financial Stability Report,released in mid-October,also highlighted the debt issue.

So what about that overwhelming debt? I want to emphasize three points here:

First,on the other side of these debts are assets. To improve economic efficiency and enterprise profitability is to solve the debt problem from the asset side. If the profitability of the asset is strong and efficiency is high,then the increase in the denominator will help reduce the leverage ratio itself. Higher profitability and efficiency make higher debt levels affordable.

Second,there is a need to allocate existing debt to more efficient sectors. Debt itself is a resource in some sense. Different industries and different sectors in the same industry are different in terms of efficiency. State-owned enterprises are often less efficient than private ones. The resources should be tilted to the ones with high efficiency.

Third,when we talk about leverage,it is not just about the real economy,but also the financial sector. It is difficult to solve the problem when not shrinking the huge financial system,not changing the complicated situation of the financial sector,and not strengthening the risk-bearing capacity of the financial sector. This is the focus of this article.

China’s Financial Complexity

To gain a deeper understanding of financial risk,we need a vantage point from which we can observe the entire economy and financial system and take a global view. Considering the following factors,we must remain highly vigilant against the financial risks that may appear in China.

First,China's debt burden is heavy,and if this does not change,the pressure will be hard to bear. In 2014,to describe a typical phenomenon of China's economy,I put forward a point of view,which I call "the impossible triangle of debt." The so-called "triangle" is high leverage,low efficiency and the fact that credit expansion cannot drive effective economic growth. It is difficult for these factors to co-exist for an extended period of time. High leverage will continue to aggravate inefficiencies and make a transition out of this environment difficult to achieve. Low efficiency worsens as a result of high leverage,and that makes leverage a greater threat. In an economic slowdown,if we continue to use high leverage to maintain low efficiency,the problems will be aggravated and a long-term trend will be formed. The answer is to reduce leverage or improve efficiency. There is no alternative. The use of loose monetary and credit policies to keep the economy running will have to come to an end.

Fortunately,China is carrying out supply-side structural reform. One of its core measures is to deleverage,reduce overcapacity,improve resource allocation and improve economic efficiency. That's the right direction. We have confidence in the success of the supply-side structural reforms,but we must also recognize that it requires sustained effort and much time. We need to attach great importance to financial risks and ensure they are not treated lightly.

Second,the bond market has expanded considerably. When credit expansion does not lead to effective economic growth,capital flows into the financial sector rather than the real economy. Bond markets are at the heart of financial and debt problems. China’s bond market is large -- the balance has increased from less than 30 trillion yuan three years ago to nearly 70 trillion yuan at present. Bond trading volume has increased from 40 trillion yuan to 120 trillion,money market financing volume has increased from 230 trillion yuan to 800 trillion yuan -- which mainly consists of overnight financing. In the face of these significant market changes,we need to adopt a completely different vision,manner and philosophy. The situation is becoming more difficult to control and a slight move in one area may affect the overall picture.

Third,China's financial system is a large and tightly linked network. Total social financing has reached 171 trillion yuan and total assets on bank balance sheets exceed 230 trillion yuan. The ratio of social financing to deposits has increased by 30% in the last three years,indicating that a large share of bank assets is not supported by deposits. The off-balance sheet assets of banks are 100 trillion yuan,and the proportion to total assets continues to rise. Interbank assets have reached 60 trillion yuan. The outsourced amount from the banking system is 15.7 trillion yuan and is growing rapidly. Banks' claims on non-bank financial institutions have risen from less than 10 trillion yuan to 27 trillion yuan in the last three years,reflecting the growing relationship between banks and non-banks. Assets under management in the whole society are as high as 112 trillion yuan (78 trillion yuan after adjusting for double counting),involving almost all financial institutions,financial markets and financial products. From the perspective of management,the business model is complex and highly interconnected.

Deleveraging on Two Sides

In 2017,to squeeze out financial bubbles,carry out deleveraging and prevent risks,China adopted a neutral monetary stance and strengthened regulation. This policy shift was part of a global phenomenon that included China,although the timing and starting point for each economy was different. Major economies are now recovering from their difficulties compared with 2016,and deflation is no longer a global challenge. Against this background,the US has entered a period of normal monetary tightening. In October last year the Fed even began to shrink its balance sheet. The European Central Bank’s stimulus campaign is drawing towards a close,and the central bank has cut back its bond-buying program. The monetary policies of the world's major central banks are differentiated but resonant. The linkage of monetary policy between China and the US is particularly obvious: The Fed has raised interest rates several times since December 2016,and the PBOC has closely followed and increased its short term interest rates. In addition to the consideration of deleveraging,the spread between domestic and US interest rates has remained fairly constant to stabilize expectations for the renminbi exchange rate and slow outflows of capital.

During this period of strict regulation and neutral monetary policy,the initial focus has been monetary policy. The PBOC has tightened short-term funds and loosened long-term funds by means of its open market operations since the beginning of August 2016. In 2017 it raised policy rates several times. Additionally,it incorporated off-balance-sheet financing into its Macro Prudential Assessment. These have all had a significant impact on conditions overall. Many institutions had to make adjustments,and this has played a positive role in the process of financial deleveraging.

Since March 2017,regulators have released new policies and guidance to put in place special administration over the financial sector. This was to avert arbitrage and improper behavior and prevent financial activities from turning to the virtual area so that the financial sector can focus on its key objective of serving the real economy. The scope and intensity of policy and guidance is unprecedented.

As regulators have focused on neutralizing monetary policy,financial institutions have begun to deleverage. This has already produced results,and can be seen clearly from two aspects. From the perspective of the market,the duration of short-term financing has been extended,the trading volume of bonds has shrunk,the bond turnover rate has dropped significantly,and the credit spread has widened. From the perspective of business structure,the pattern of asset management has undergone positive changes. The channel business ¨C or the channeling of funds from banks to non-bank financial institutions - has been reduced,banks’ off-balance sheets have been compressed,and the outsourced funds from banks have been redeemed. Although progress has been made,we are still a long way from reaching our targets,however. The process is at a crossroads,both for investors and regulators.

Financial institutions are under pressure to deleverage. Compressing assets and reducing debt is essential,and it is important to adjust the strategy under the pressure of passive deleveraging. This is a wise choice. It is unsustainable to use interbank liabilities to maintain financial plans. The proportion of off-balance sheet assets is too large and should be compressed appropriately. Outsourcing and channel operations are too aggressive,and this should be addressed in an active manner.

For regulators,in order to deleverage,it is natural for financial institutions to experience some pressure in order to squeeze their assets and liabilities. This is a move in the right direction. But regulators should also be aware of priorities and help give markets a stable outlook. While maintaining this high pressure,regulators should take the whole situation into account and plan accordingly,control the pace of their actions and make progress gradually,so as to avoid excessive adjustments and a loss of control.

An Assessment of the Debt Overhang

People who hold a bearish view of China’s economy have once again been disappointed. Over the past year,China's capital outflows have been effectively controlled. Foreign exchange reserves have reversed their decline and started to edge higher. Meanwhile renminbi exchange rate expectations have stabilized and the local currency has even appreciated against the dollar. GDP grew by 6.9% last year,industrial capacity utilization increased sharply,and the deflation risk decreased. The contribution of consumption to GDP has risen,the service sector has continued to expand,scientific and technological progress has achieved remarkable results,and air quality has improved.

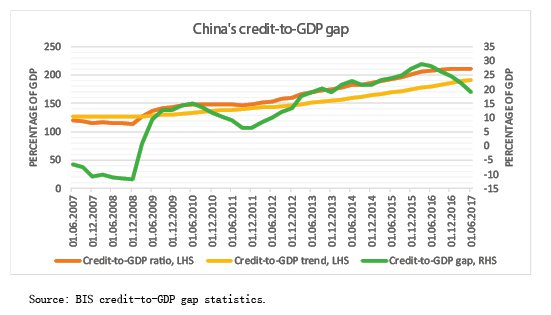

Moreover,it is important to note that the pace of credit expansion has finally slowed,overall leverage has fallen and the financial system has become less complex. According to the Bank for International Settlements (BIS),there has been a narrowing of China's credit-to-GDP gap -- defined as the difference between the credit-to-GDP ratio and its long-term trend -- captures the build-up of exce